Innovation & R&D: Top 3 Defense Contractors Compared

Comparing the top three defense contractors reveals distinct approaches to innovation and R&D spending, driven by their core competencies, strategic priorities, and willingness to embrace disruptive technologies and integrate diverse intellectual capital to maintain a competitive edge and address evolving global threats.

In the complex and rapidly evolving landscape of global security, understanding What are the Key Differences Between the Top 3 Defense Contractors in Terms of Innovation and R&D Spending? is crucial. These industrial giants actively shape geopolitical realities through their technological advancements, making their investment strategies a focal point for defense analysts, investors, and policymakers alike.

The Landscape of Defense Innovation: An Overview

The defense industry is characterized by an incessant demand for cutting-edge technology, driven by the imperative to maintain strategic superiority and respond to dynamic threat environments. This forces defense contractors to invest significantly in research and development (R&D). However, the scale and focus of these investments can vary dramatically among the sector’s leading players.

Innovation in this sector isn’t merely about developing new weapons systems; it encompasses advancements in materials science, cybersecurity, artificial intelligence, autonomous systems, and advanced manufacturing. These areas are crucial for creating integrated defense solutions that offer both offensive and defensive capabilities, while also reducing costs and improving efficiency.

The quest for innovation often involves a delicate balance between proprietary in-house development and strategic collaborations. Companies frequently partner with smaller tech firms, universities, and even international entities to access specialized expertise and accelerate development cycles, recognizing that no single entity holds a monopoly on groundbreaking ideas.

Understanding the unique R&D philosophies of the top defense contractors provides insight into their future trajectories and their potential impact on global military capabilities. Each company, while operating within the same overarching market, cultivates distinctive strengths and allocates resources based on a blend of historical expertise, current market demands, and anticipated future challenges.

Lockheed Martin: Pioneering with Purpose

Lockheed Martin stands as a titan in the defense industry, particularly renowned for its prowess in aeronautics, missiles, and space systems. Its innovation strategy is often seen as deeply integrated with large-scale, high-impact programs, emphasizing revolutionary advancements rather than incremental changes. The company consistently ranks among the top in R&D spending, a testament to its commitment to maintaining a technological edge.

A significant portion of Lockheed Martin’s R&D budget is allocated to areas that promise transformative capabilities. This includes next-generation stealth technology, hypersonic weapons, and advanced satellite systems. Their approach is characterized by deep expertise in complex systems integration, ensuring that disparate technologies work seamlessly together to achieve mission objectives.

Strategic R&D Focus Areas

- Hypersonics: Investing heavily in the development of vehicles capable of speeds exceeding Mach 5, crucial for future strike capabilities.

- Stealth Technology: Continuous refinement of low-observable platforms, building on their legacy with aircraft like the F-35 and F-22.

- Space Systems: Advancing satellite communication, navigation, and reconnaissance, critical for modern warfare.

Beyond these established domains, Lockheed Martin is also aggressively exploring emerging fields such as artificial intelligence and quantum computing. Their strategy often involves a combination of internal research labs, strategic partnerships with academic institutions, and acquisitions of specialized technology firms. This multi-pronged approach ensures they remain at the forefront of technological innovation.

The company’s R&D culture often emphasizes long-term vision, undertaking projects that may not yield immediate returns but are deemed essential for future strategic advantage. This patience is often rewarded with market-leading products that define subsequent generations of defense capabilities.

Boeing Defense, Space & Security: Diversified Innovation

Boeing, while globally recognized for its commercial aircraft, also commands a significant presence in the defense, space, and security sectors. Their innovation and R&D spending are characterized by a slightly broader, more diversified portfolio compared to some of their pure-play defense counterparts. This diversification allows them to leverage technologies developed for commercial applications into defense solutions, and vice versa.

Boeing’s R&D efforts in defense are particularly strong in military aircraft, helicopters, and unmanned systems. They are also a key player in network-centric operations, focusing on connecting diverse platforms and sensors to create a more integrated battlespace. Their approach to innovation is often more pragmatic, aiming for modularity and adaptability in their designs.

Key Pillars of Boeing’s R&D

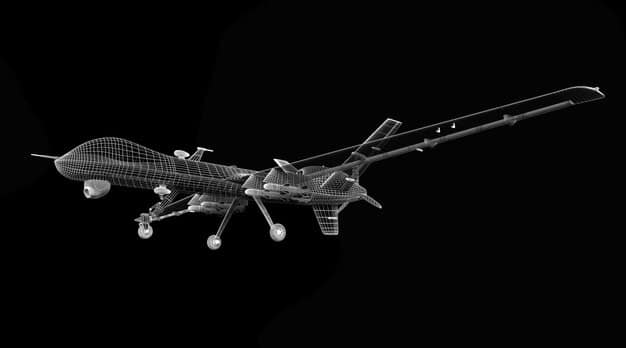

- Autonomous Systems: Developing advanced unmanned aerial vehicles (UAVs) and ground-based autonomous platforms for various military roles.

- Connectivity and Networking: Enhancing the ability to link disparate systems and share data across the battlefield, critical for decision advantage.

- Digital Engineering: Utilizing advanced simulation and modeling tools to accelerate design, testing, and production processes, reducing costs and timelines.

Boeing’s commercial heritage provides a unique advantage in terms of manufacturing scale and efficiency, which they often seek to apply to their defense programs. Their innovation process benefits from a strong engineering culture and a focus on incremental improvements that can significantly enhance performance and reduce operational costs of existing platforms.

The company’s investment in R&D is often distributed across both mature programs and nascent technologies, ensuring a continuous pipeline of upgrades for current systems alongside the development of entirely new capabilities. This balanced approach allows them to address immediate needs while also positioning themselves for future market shifts.

Raytheon Technologies: Integrated Defense Solutions

Raytheon Technologies emerged from the merger of Raytheon Company and United Technologies Corporation aerospace businesses, creating a powerhouse focused on integrated defense and aerospace systems. This merger brought together complementary strengths, particularly in advanced avionics, missile defense, intelligence, surveillance, and reconnaissance (ISR) systems.

Raytheon’s R&D spending reflects its emphasis on sensor technologies, precision weapons, and command and control systems. Their innovation strategy is deeply rooted in systems integration and creating holistic solutions that enhance the effectiveness of military operations across air, land, sea, space, and cyber domains. They are known for their strong capabilities in developing radar systems, electronic warfare, and cybersecurity solutions.

Innovation Drivers at Raytheon

- Advanced Sensors: Continuously improving radar, infrared, and other sensing technologies for enhanced situational awareness and targeting.

- Precision Munitions: Developing smart weapons with greater accuracy, range, and adaptability to various targets and environments.

- Cybersecurity: Investing in solutions to protect critical infrastructure and defense systems from sophisticated cyber threats.

The company leverages its diverse technological base to offer integrated solutions that address complex national security challenges. For example, their work in missile defense combines advanced sensors, interceptors, and command systems into a coherent defense architecture. This integrated approach often means that their R&D investments are geared towards optimizing the interplay of various components.

Raytheon’s R&D also extends to areas like directed energy weapons and advanced materials, looking for disruptive technologies that could fundamentally alter the landscape of military engagement. Their focus on end-to-end solutions, from detection to engagement, differentiates their innovation strategy.

The post-merger synergy allows Raytheon Technologies to pursue broader R&D initiatives, combining the legacy expertise of both entities. This enables them to address multi-domain operations with a more comprehensive technological suite, positioning them as a leading provider of integrated defense systems.

Comparative Analysis of R&D Approaches

While all three contractors are leaders in defense, their approaches to innovation and R&D spending reveal distinct philosophical underpinnings. Lockheed Martin often pursues “big bets,” focusing on defining the next generation of singular, high-performance platforms that are game-changers. Their R&D is frequently tied to large, long-term government contracts that dictate significant investment in specific, advanced capabilities.

Boeing, with its dual commercial and defense identity, tends to emphasize the transferability of technology and the efficiency of production. Their R&D sometimes looks for innovations that can be scaled or adapted across different product lines, leading to a more diversified, though perhaps less singularly focused, portfolio of projects. They might prioritize modularity and commonality to reduce lifecycle costs.

Raytheon Technologies, particularly post-merger, stands out for its focus on integrated systems and networked solutions. Their R&D investments are heavily concentrated on making disparate systems work together seamlessly, enhancing overall mission effectiveness rather than just individual platform performance. They often lead in sensing, effects, and C3I (Command, Control, Communications, and Intelligence) technologies.

A significant difference lies in their comfort with risk and the type of innovation they pursue. Lockheed Martin might be more inclined towards highly speculative, high-reward endeavors. Boeing might favor innovations that can be integrated into existing product lines or scale to commercial applications. Raytheon often focuses on systemic improvements and the synergistic combination of technologies.

Impact of Market Dynamics and Government Funding

The defense industry’s innovation landscape is heavily influenced by market dynamics and government funding priorities. Unlike the commercial sector, R&D in defense is often tightly coupled with government budgets, evolving threat perceptions, and specific program requirements. This can shape how and where defense contractors allocate their innovation spending.

When governments prioritize certain capabilities, for example, hypersonic weapons or space-based assets, the major contractors will align their internal R&D to compete for those lucrative contracts. This creates a feedback loop where government needs drive company investment, and company innovations can, in turn, influence future government requirements.

The shift towards multi-domain operations and “all-domain deterrence” is also prompting contractors to invest in technologies that enable seamless integration across air, land, sea, space, and cyber. This trend encourages cross-disciplinary R&D and incentivizes companies to develop solutions that can operate effectively in complex, interconnected environments.

Furthermore, the drive for affordability and readiness often pushes contractors to innovate in areas like sustainment, predictive maintenance, and digital engineering, which can reduce the long-term cost of ownership for defense systems. This dual imperative of cutting-edge performance and cost-effectiveness remains a constant challenge and a key driver of R&D.

Future Trends and Collaborative Imperatives

Looking ahead, the future of innovation and R&D spending within the defense sector will likely be shaped by several overarching trends. The increasing sophistication of adversaries, the proliferation of advanced technologies globally, and the emergence of non-traditional threats (like cyber-attacks on critical infrastructure) will continue to drive demand for cutting-edge solutions.

Artificial intelligence (AI) and machine learning (ML) are becoming foundational technologies across all defense domains. Contractors are investing heavily in AI for everything from autonomous decision-making in unmanned systems to predictive intelligence and cybersecurity. This represents a significant shift from traditional hardware-centric R&D.

Quantum computing and advanced materials also hold immense promise, albeit with longer development cycles. These technologies could unlock entirely new capabilities in cryptography, sensing, and energy, fundamentally altering the balance of power. Contractors are establishing dedicated research units and partnerships to explore these nascent fields.

Emerging Technologies Driving Future R&D

- Quantum Technologies: Investing in quantum computing, sensing, and secure communications for future advantages.

- Directed Energy Weapons: Developing lasers and high-power microwaves for defensive and offensive applications.

- Additive Manufacturing: Exploring 3D printing for rapid prototyping, on-demand parts production, and novel material structures.

The imperative for collaboration is also growing. Defense contractors are increasingly engaging with smaller startups, venture capital arms, and academic institutions to tap into a wider pool of innovative ideas and talent. This open-innovation model recognizes that the pace of technological change often outstrips what even the largest corporations can achieve internally.

International partnerships will also play a greater role, both in co-developing new systems and in facilitating technology transfer. The global nature of threats often necessitates a coordinated, multinational approach to defense innovation, further blurring the lines of purely national R&D efforts.

Challenges and Opportunities in Defense R&D

Despite the significant investments, defense R&D faces unique challenges. The long development cycles and high costs associated with major defense programs can be a barrier, making it difficult to pivot quickly to emerging threats or technologies. Regulatory hurdles, security classifications, and intellectual property concerns also add layers of complexity.

Maintaining a highly skilled workforce capable of pushing the boundaries of science and engineering is another persistent challenge. The competition for top talent with the commercial tech sector is fierce, requiring defense contractors to offer compelling opportunities and foster a culture of innovation.

However, these challenges also present opportunities. The demand for resilience and adaptability in defense systems drives innovation in modular design and open architectures, making systems easier to upgrade and less dependent on proprietary solutions. The push for multi-domain integration fosters cross-disciplinary research and encourages novel combinations of existing technologies.

The increasing focus on data analytics and artificial intelligence is creating new avenues for defense companies to generate value, not just through hardware, but through processing and interpreting vast amounts of information to provide actionable intelligence. This shift is turning defense contractors into sophisticated data companies as well.

Moreover, the global security landscape ensures a continuous, strong demand for advanced defense capabilities, providing a stable, albeit cyclical, market for R&D investments. Companies that can effectively navigate these complexities, embrace new technologies, and foster collaborative ecosystems will be best positioned for long-term success.

| Key Area | Brief Description of Differences |

|---|---|

| 🚀 Lockheed Martin | Focuses on revolutionary “big bets” in stealth, hypersonics, and space technology, with long-term vision. |

| ✈️ Boeing Defense | Diversified R&D, leveraging commercial tech for military aircraft, autonomous systems, and digital engineering. |

| 🛰️ Raytheon Technologies | Specializes in integrated defense solutions, excelling in sensors, precision weapons, and cybersecurity. |

| 🔬 R&D Approach | LM: Transformative, system-defining. Boeing: Adaptable, cross-platform. Raytheon: Integrated, multi-domain. |

Frequently asked questions about defense contractors’ R&D

Defense contractors invest heavily in R&D to maintain a technological advantage against evolving global threats. This continuous innovation ensures that military forces have access to cutting-edge systems, leading to superior capabilities and strategic superiority in complex operational environments. It’s a key long-term competitive differentiator.

Government funding significantly influences defense R&D by setting priorities and providing the financial backbone for expensive, long-term projects. Contracts for specific programs, like new aircraft or missile systems, directly guide where defense contractors allocate their research and development resources, aligning with national security objectives.

The top defense contractors are increasingly focusing on artificial intelligence, machine learning, quantum computing, advanced autonomous systems, and directed energy weapons. These technologies promise to revolutionize warfare, offering capabilities like enhanced decision-making, predictive intelligence, and new forms of engagement, reshaping future defense strategies.

Yes, there is significant collaboration. Major defense contractors often partner with smaller tech firms, startups, and academic institutions. This strategy allows them to access specialized expertise, accelerate innovation cycles, and integrate disruptive technologies more rapidly into their systems. It fosters a broader ecosystem for defense innovation and talent development.

Their distinct R&D approaches directly shape their product portfolios. Lockheed Martin’s focus on “big bets” yields iconic, revolutionary platforms. Boeing’s diversified approach leads to systems with commercial crossovers and adaptable designs. Raytheon’s integrated systems focus results in comprehensive, networked solutions for complex defense challenges.

Conclusion

The leading defense contractors—Lockheed Martin, Boeing Defense, and Raytheon Technologies—each exhibit unique strengths and strategic priorities in their innovation and R&D spending. While all are committed to advancing national security capabilities, their distinct philosophies concerning risk, integration, and technological focus define their contributions to the evolving landscape of defense. Understanding these differences provides crucial insight into where future defense advancements are likely to emerge and how these industry titans continue to shape geopolitical realities through their relentless pursuit of technological superiority.