US Trade Agreements: Impact on Manufacturing & Job Growth

The implications of new US trade agreements on domestic manufacturing and job growth are multifaceted, potentially leading to reshoring, increased domestic production, and demand for skilled labor, while also posing challenges related to competitiveness, supply chain adjustments, and adaptation to global market shifts.

Understanding what are the implications of the new US trade agreements on domestic manufacturing and job growth is a critical endeavor, as these policies significantly reshape economic landscapes. From the factory floor to global supply chains, trade agreements influence everything from production costs to employment rates, making their analysis essential for businesses and policymakers alike.

The Evolution of US Trade Policy and its Core Objectives

The landscape of US trade policy is in a constant state of flux, driven by geopolitical realities, technological advancements, and shifting domestic priorities. Historically, US trade agreements often prioritized market access for American goods and services abroad, seeking to reduce tariffs and non-tariff barriers to foster export-led growth. This approach was underpinned by theories of comparative advantage, suggesting that countries benefit from specializing in what they produce most efficiently and trading with others.

However, recent shifts have introduced a stronger focus on domestic concerns. There’s a growing emphasis on ensuring fair competition, protecting intellectual property, and, significantly, strengthening domestic manufacturing capabilities and job creation. This pivot reflects a recognition that while global trade offers many benefits, it can also lead to challenges for certain sectors and workforces at home. The objectives now often include a strategic re-evaluation of supply chains, aiming to reduce reliance on single foreign sources and enhance national security through increased self-sufficiency in critical industries.

Modern trade agreements are no longer solely about tariff reductions. They increasingly delve into complex areas such as labor standards, environmental protections, digital trade, and even state-owned enterprise behavior. These additions reflect a broader understanding of what constitutes “fair” and “free” trade in the 21st century. The underlying aim is to create a more level playing field for American companies and workers, addressing concerns about practices that might disadvantage domestic industries. This multifaceted approach seeks to balance the gains from international trade with the imperative to foster a robust and resilient domestic economy.

Ultimately, the core objective has broadened to encompass not just economic efficiency, but also economic security, national resilience, and promoting equitable growth within the country. This means that while traditional economic indicators remain important, social and strategic considerations are playing an increasingly prominent role in shaping how the US engages with the global trading system. The shift represents an acknowledgment that trade policy is a powerful tool for achieving a diverse range of national goals, extending beyond mere commerce to touch upon geopolitics and societal well-being.

Direct Impacts on Domestic Manufacturing

New US trade agreements often target specific sectors, aiming to bolster domestic manufacturing capabilities. This can manifest through various mechanisms, such as stricter rules of origin, which demand a higher percentage of a product’s components be sourced within the US or signatory countries. Such rules are designed to incentivize companies to increase their domestic production, thereby creating a stronger demand for American-made parts and materials.

Reshoring and Supply Chain Resilience

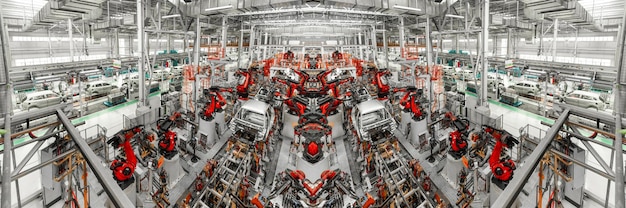

One of the most profound implications is the potential for reshoring, where companies relocate production facilities back to the United States. This trend is not solely driven by trade agreements but is certainly amplified by them, especially when combined with factors like rising labor costs abroad or geopolitical instability. Reshoring initiatives aim to shorten supply chains, making them less vulnerable to disruptions and enhancing national security, particularly in strategic industries like pharmaceuticals, semiconductors, and defense. This strategic re-evaluation of supply chains is a direct response to lessons learned from recent global crises.

* Reduced vulnerability to external shocks

* Enhanced control over production quality and standards

* Creation of new domestic manufacturing jobs

* Stimulation of related support industries

The emphasis on supply chain resilience means that businesses are increasingly looking beyond mere cost efficiency. They are weighing risks associated with lengthy, complex international supply networks against the benefits of closer, more controllable domestic production. This often involves significant capital investment in new US-based facilities and technology, representing a long-term commitment to domestic manufacturing growth.

Competitive Shifts and Technological Adoption

While some sectors benefit from increased protections, others might face new competitive pressures or be forced to innovate. Trade agreements can influence the flow of technology and intellectual property, impacting how domestic manufacturers adopt new processes. For instance, provisions relating to digital trade and data localization can affect how industries utilize global digital platforms and cloud services. This dynamic encourages domestic firms to invest in advanced manufacturing techniques, such as automation and artificial intelligence, to remain competitive globally.

The shift towards advanced manufacturing not only increases productivity but also demands a highly skilled workforce, pushing for greater investment in education and vocational training. The competitive landscape is not just about producing more, but about producing smarter and more efficiently. This can lead to a dual effect: while some traditional manufacturing jobs might be automated away, new, higher-skilled positions emerge in areas like robotics, data analytics, and software development for industrial applications.

Job Growth: Quantity, Quality, and Skill Requirements

The promise of job growth is a central argument for shaping new trade agreements that prioritize domestic production. The direct effect of increased manufacturing activity is often a rise in employment within those sectors. However, the nature of these jobs and the skills required are constantly evolving. It’s not just about adding positions, but about creating sustainable, high-quality employment opportunities that contribute to a resilient economy.

The current trend leans towards jobs that require higher levels of technical proficiency and problem-solving skills. As automation and AI become more integrated into manufacturing processes, the demand for purely manual labor may decrease, while the need for workers who can manage, maintain, and program these advanced systems grows. This shift necessitates significant investment in workforce development and training programs aimed at upskilling the existing labor force and preparing new entrants for the demands of modern manufacturing.

Addressing Labor Standards and Wages

Many new trade agreements include provisions on labor standards, aiming to prevent unfair competition stemming from countries with lower labor costs and weaker worker protections. By setting minimum standards for wages, working conditions, and the right to organize, these agreements can potentially reduce the incentive for companies to offshore production simply to exploit cheaper labor. This can help to level the playing field and mitigate downward pressure on domestic wages.

Moreover, a focus on higher-value manufacturing (e.g., specialized components, advanced machinery) often translates into better-paying jobs. These positions typically require specialized training and expertise, leading to increased earning potential for workers. The emphasis is not just on creating a large number of jobs, but a growing number of well-compensated positions that contribute to a stronger middle class.

Challenges in Workforce Transition

Despite the potential for job growth, significant challenges exist in transitioning the workforce to meet these new demands. Workers from traditional manufacturing sectors may require extensive retraining to adapt to new technologies and processes. This transition isn’t always smooth and can lead to temporary displacement or a skills gap if adequate support and educational infrastructure are not in place.

* Need for continuous education and vocational training

* Bridging the gap between available skills and industry demands

* Potential for job displacement in less skilled roles

* Geographic disparities in job creation and access to training

Furthermore, the automation trend, while increasing productivity, can also lead to fewer overall jobs in some areas of manufacturing compared to historical levels. Therefore, policymakers must carefully balance incentivizing domestic production with preparing the workforce for a future where the nature of work itself is fundamentally changing. The goal is to maximize the benefits of advanced manufacturing while minimizing social disruption.

Supply Chain Reconfiguration and Regional Implications

New US trade agreements are acting as a catalyst for a significant reconfiguration of global supply chains. The drive for greater resilience, national security, and domestic job creation is leading companies to re-evaluate their sourcing strategies, often favoring closer-to-home options or those within allied nations. This shift has profound regional implications within the United States.

The emphasis on “friend-shoring” or “near-shoring” means industries are increasingly looking to source components and semi-finished goods from geographically proximate countries or those with strong political alliances. This can reduce transit times, shipping costs, and exposure to geopolitical risks. For domestic manufacturing, this could mean an increased demand for raw materials and intermediate goods produced within the US, as well as from neighboring countries like Canada and Mexico.

Impacts on Different US Regions

The implications are not uniform across the US. States with a strong existing manufacturing base, particularly in sectors targeted by trade agreements (e.g., automotive, defense, semiconductors), are likely to see the most direct benefits from increased domestic production. The rust belt region, for instance, could experience a revitalization as factories reopen or expand to meet demand.

Conversely, regions heavily reliant on specific imports that become more expensive due to tariffs or new regulations might face challenges. Consumers in these regions could see higher prices, and businesses relying on those imports might have to adjust their strategies or seek new suppliers, which can be costly and time-consuming.

Strategic Relocation of Industries

There is a concerted effort to strategically relocate vital industries back to the US. This is particularly evident in sectors like semiconductor manufacturing, where massive investments are being made to build new fabrication plants domestically. Government incentives, coupled with trade policies, are designed to make these relocations economically viable.

* Development of industrial clusters in specific regions

* Increased investment in infrastructure to support new facilities

* Potential for economic revitalization in manufacturing-heavy states

* Challenges in balancing regional growth with national economic goals

This strategic relocation often involves significant infrastructure development—from power grids to transportation networks—to support these new industrial hubs. It also fosters the growth of ancillary services and businesses, creating a ripple effect of economic activity in the surrounding areas. The long-term goal is to build a more robust and self-reliant industrial base capable of weathering future global disruptions.

Challenges and Opportunities for US Businesses

The evolving landscape of US trade agreements presents a mix of significant challenges and promising opportunities for American businesses. Navigating these changes requires adaptability, strategic foresight, and sometimes, substantial investment. Understanding these dynamics is crucial for companies looking to thrive in this new environment.

One major challenge is the adjustment to new rules of origin, tariffs, or non-tariff barriers. Businesses with established international supply chains may need to redesign their sourcing strategies, which can involve identifying new suppliers, negotiating different terms, and potentially investing in new domestic production capacity. This transition can be costly and complex, requiring careful planning and execution to avoid disruptions.

Navigating Increased Costs and Competition

New agreements, particularly those aimed at promoting domestic production, can sometimes lead to increased costs for businesses. Sourcing materials or components domestically might be more expensive than procuring them from traditional international suppliers, at least initially. These higher input costs could potentially erode profit margins or lead to higher prices for consumers if not managed effectively.

Furthermore, while domestic manufacturing is encouraged, some agreements might open up certain sectors to increased competition from other signatory countries. Businesses must ensure they remain competitive through innovation, efficiency gains, and product differentiation. This means a continuous focus on R&D and process improvement.

Leveraging New Market Access

On the flip side, new trade agreements can open up previously restricted markets for US exports. Reduced tariffs and streamlined regulatory processes in partner countries can create significant opportunities for American businesses to expand their customer base and increase sales abroad. This is particularly beneficial for sectors where the US holds a comparative advantage.

Access to new markets can also lead to economies of scale, allowing domestic manufacturers to produce more efficiently and spread their fixed costs over a larger volume of output. This can, in turn, help offset some of the increased costs associated with domestic sourcing or production.

* Opportunities for export expansion

* Potential for economies of scale

* Enhanced protection of intellectual property abroad

* Incentives for innovation and efficiency

Moreover, provisions related to intellectual property protection in new agreements can be a major advantage for innovation-driven US companies. Stronger international legal frameworks protect their patents, trademarks, and copyrights, reducing the risk of counterfeiting and unfair competition in foreign markets. This encourages continued investment in research and development, fostering long-term competitiveness.

The Role of Government Policy and Incentives

Government policy plays a pivotal role in shaping the implications of new US trade agreements on domestic manufacturing and job growth. Trade policies are rarely standalone initiatives; they are often complemented by a suite of domestic incentives, regulations, and investments designed to maximize their desired effects. These measures are crucial for translating trade agreement objectives into tangible economic outcomes.

Financial Incentives and Subsidies

Often, new trade agreements are paired with direct financial incentives to encourage domestic investment and reinforce specific industries. This can include tax credits for companies that reshore manufacturing operations, grants for research and development in critical technologies, or subsidies for workforce training programs. Such incentives aim to mitigate the higher initial costs associated with establishing or expanding domestic production facilities.

For instance, legislation like the CHIPS Act, while not a trade agreement itself, acts in parallel by providing massive subsidies for semiconductor manufacturing within the US. This kind of targeted industrial policy, combined with trade measures that safeguard domestic markets or create new export opportunities, creates a powerful ecosystem for growth in strategic sectors. These financial boosts are designed to make “Made in America” a more economically attractive option.

Regulatory Frameworks and Infrastructure Investment

Beyond direct financial support, government policy also involves establishing favorable regulatory frameworks. This can include streamlining permitting processes for new factories, investing in public infrastructure (like ports, roads, and energy grids) to support industrial expansion, and developing clear standards that protect domestic industries while facilitating fair trade. A simplified regulatory environment can significantly reduce the burden on businesses seeking to invest domestically.

Furthermore, national infrastructure projects, often bipartisan in nature, directly support the objectives of trade agreements focused on domestic production. Improved logistics, reliable energy supplies, and digital infrastructure are all critical components for a competitive manufacturing sector. These investments ensure that the physical and digital arteries of industry are robust enough to handle increased demand and activity.

* Targeted tax credits and grants for domestic investment

* Investment in physical and digital infrastructure

* Streamlined regulatory processes for manufacturing

* Funding for vocational training and skill development programs

Workforce Development Initiatives

A critical element of government policy is investment in workforce development. As industries evolve and automation becomes more prevalent, the need for new skills arises. Governments often fund vocational training programs, apprenticeships, and STEM education initiatives to ensure a pipeline of skilled labor for advanced manufacturing. These programs are vital for bridging the skills gap and ensuring that job growth translates into economically viable opportunities for the population.

These initiatives are crucial for ensuring that the benefits of renewed manufacturing are broadly shared across the workforce. By preparing individuals for the jobs of the future, government policy helps to create a resilient and adaptable labor market, essential for sustained economic growth in the face of global competition and technological change.

Long-Term Economic and Geopolitical Considerations

The implications of new US trade agreements extend far beyond immediate changes in manufacturing output or job numbers. They ripple through the broader economy and play a significant role in shaping the United States’ geopolitical stance. These long-term considerations are central to understanding the full scope of trade policy decisions.

From an economic standpoint, the shift towards domestic production aims to create a more resilient and self-sufficient economy. Reducing dependency on foreign supply chains for critical goods can provide greater stability during global crises, limit inflationary pressures from external shocks, and ensure the availability of essential products. This resilience is a strategic asset in an increasingly uncertain world.

Shaping Global Alliances and Influence

Trade agreements are powerful diplomatic tools. By forming preferential trade relationships, the US can strengthen its geopolitical alliances, providing economic incentives for partner nations to align with American interests. Conversely, trade restrictions can be used as leverage against countries whose practices are deemed unfair or contrary to US values. This economic statecraft is a key component of modern foreign policy.

The alignment of trade strategies with foreign policy objectives means that economic decisions often have significant geopolitical ramifications. For instance, focusing trade on democracies or countries with strong rule of law can reinforce shared values and create a more predictable and stable international economic order. This is part of a broader strategy to shape the global economic architecture.

Innovation, Competitiveness, and Sustainable Growth

In the long run, new trade agreements aim to foster an environment conducive to innovation and sustained economic competitiveness. By protecting intellectual property, encouraging domestic R&D, and promoting fair competition, these policies can spur technological advancements and higher-value production. This ultimately leads to a more productive and dynamic economy capable of generating wealth and high-quality jobs.

However, there is a perpetual balancing act. While protectionist measures might temporarily shield domestic industries, excessive reliance on them can stifle innovation and lead to complacency. The challenge is to create policies that encourage domestic growth without isolating the US economy from the vital forces of global competition and technological exchange. The goal is to cultivate a manufacturing sector that is not just bigger, but smarter, more agile, and globally competitive.

Assessing the Overall Impact and Future Outlook

Assessing the overall implications of new US trade agreements on domestic manufacturing and job growth requires a nuanced perspective, acknowledging both the intended benefits and potential unintended consequences. While the goal is clear—to strengthen American industry and employment—the path is complex and filled with variables.

On the positive side, these agreements are undeniably driving a renewed focus on domestic production. This is leading to significant investments in new facilities, a push for advanced manufacturing technologies, and a strategic re-evaluation of supply chain vulnerabilities. The long-term benefits could include a more resilient economy, reduced reliance on potentially unstable foreign sources, and a stronger industrial base capable of supporting national security. The creation of high-skilled jobs in sectors vital for future economic growth is also a significant potential outcome.

However, the transition is not without its difficulties. Businesses face challenges in adapting to new rules, managing potentially higher costs, and navigating complex regulatory landscapes. Workers may need to acquire new skills, and the pace of automation means that while job quality may improve, the sheer volume of jobs in some traditional manufacturing areas might not return to historical peaks. Balancing consumer prices with the cost of domestic production also remains a persistent challenge.

Future Outlook for Manufacturing and Employment

The future outlook suggests a continued emphasis on strategic industries, advanced manufacturing, and supply chain resilience. Trade policy will likely remain a dynamic tool, constantly adapting to global economic shifts, technological progress, and evolving geopolitical realities. There will be an ongoing need for collaboration between government, industry, and educational institutions to ensure that domestic manufacturing remains vibrant and that the workforce is equipped for the jobs of tomorrow.

The long-term success of these trade imperatives will depend on several factors: the willingness of US businesses to invest domestically, the effectiveness of government incentives, the adaptability of the American workforce, and the overall global economic environment. The goal is not just to bring back manufacturing, but to build a future-proof, innovative, and competitive industrial sector that provides high-quality, sustainable employment for Americans. It’s a continuous journey of adjustment, opportunity, and strategic recalibration.

| Key Area | Brief Description |

|---|---|

| 🏭 Domestic Manufacturing | Increased focus on reshoring and local production, driven by new rules of origin and supply chain resilience. |

| 👷 Job Growth Dynamics | Shift towards high-skilled jobs in advanced manufacturing; demand for continuous workforce training. |

| ⛓️ Supply Chain Resilience | Reconfiguration efforts aiming for shorter, more secure supply lines, reducing reliance on single foreign sources. |

| 🏛️ Government Influence | Policies and incentives like tax credits and infrastructure investment crucial for sustaining domestic growth. |

Frequently Asked Questions About US Trade Agreements

New trade agreements can influence manufacturing costs by imposing rules of origin, tariffs, or non-tariff barriers that may increase the expense of sourcing materials from certain countries. While domestic sourcing might initially be costlier than traditional international options, government incentives often aim to offset these increased costs, making local production more viable.

Many new jobs spurred by modern trade agreements, particularly those in advanced manufacturing, tend to be higher-paying due to the specialized skills required. As industries adopt automation and AI, the demand for highly technical and skilled labor increases, leading to better compensation. However, this also necessitates investment in continuous education and vocational training to meet these evolving skill requirements.

Reshoring refers to the practice of relocating manufacturing and other business operations back to a company’s home country. Trade agreements often impact reshoring by establishing incentives like stricter rules of origin or reduced tariffs for domestically produced goods. They also address supply chain security and reduce reliance on foreign nations, encouraging companies to bring production closer to home.

Trade agreements ensure fair competition through various provisions, including intellectual property protections, anti-dumping measures, and regulations against unfair subsidies or state-owned enterprise practices. They also increasingly include labor and environmental standards, aiming to prevent countries from gaining an unfair cost advantage by exploiting workers or neglecting ecological safeguards, thus leveling the playing field for domestic industries.

US businesses face challenges such as adapting to new supply chain requirements, potentially higher domestic production costs, and complex regulatory changes. While opportunities for market expansion exist, businesses must also invest in innovation and efficiency to remain competitive in a shifting global landscape. Strategic planning and investment are crucial for navigating these new trade realities successfully.

Conclusion

The implications of new US trade agreements on domestic manufacturing and job growth are profound and multifaceted, signaling a strategic pivot towards a more resilient and self-sufficient national economy. These agreements are not merely about tariffs and quotas; they actively reshape supply chains, incentivize reshoring, and redefine the nature of industrial employment. While they promise a revitalization of American industry and the creation of high-skilled jobs, they also demand significant adaptation from businesses and a commitment to continuous workforce development. Ultimately, the long-term success hinges on a cohesive strategy that integrates trade policy with robust domestic investments, ensuring that the US remains competitive and secure in an ever-evolving global landscape.